Modified Accelerated Cost Recovery System (MACRS)

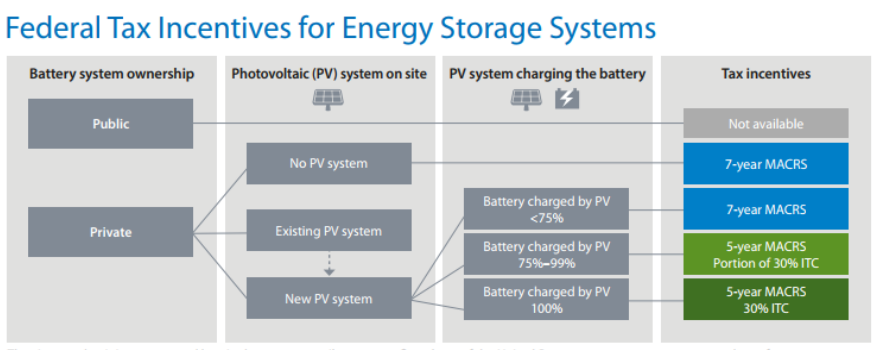

Modified Accelerated Cost Recovery System (MACRS) is a depreciation schedule in the US. MACRS depreciation applies to storage depending on who owns the battery and how the battery is charged. The following schematic published by NREL explains which type of MACRS applies to which system:

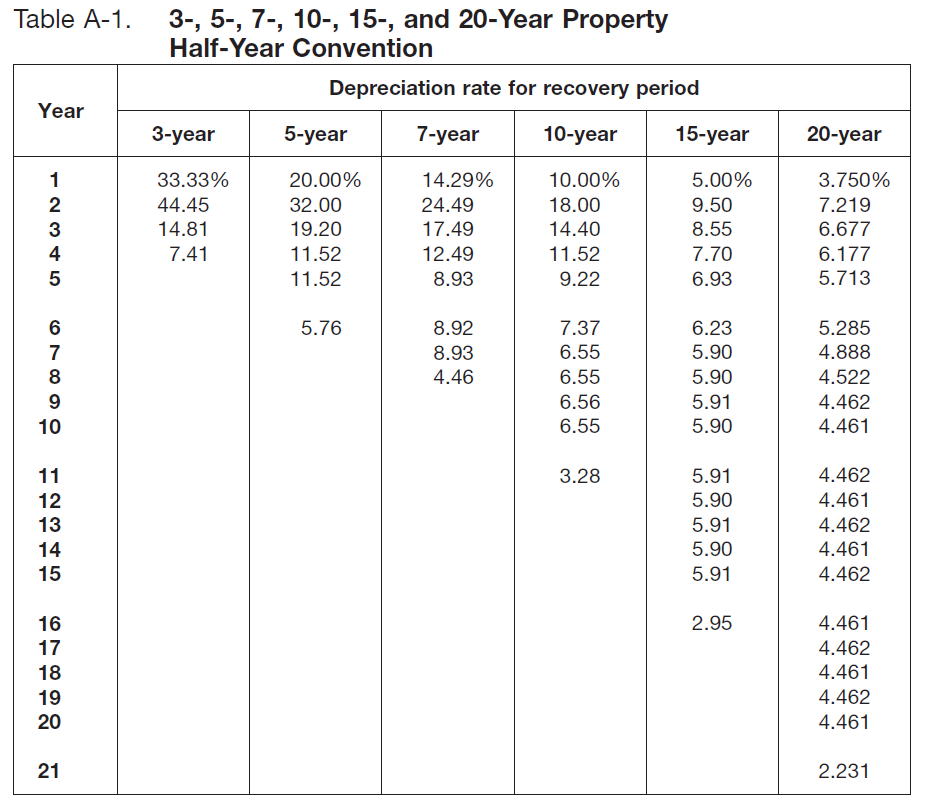

You can find the exact schedule for MACRS (Table A-1) in this IRS document: https://www.irs.gov/pub/irs-pdf/p946.pdf

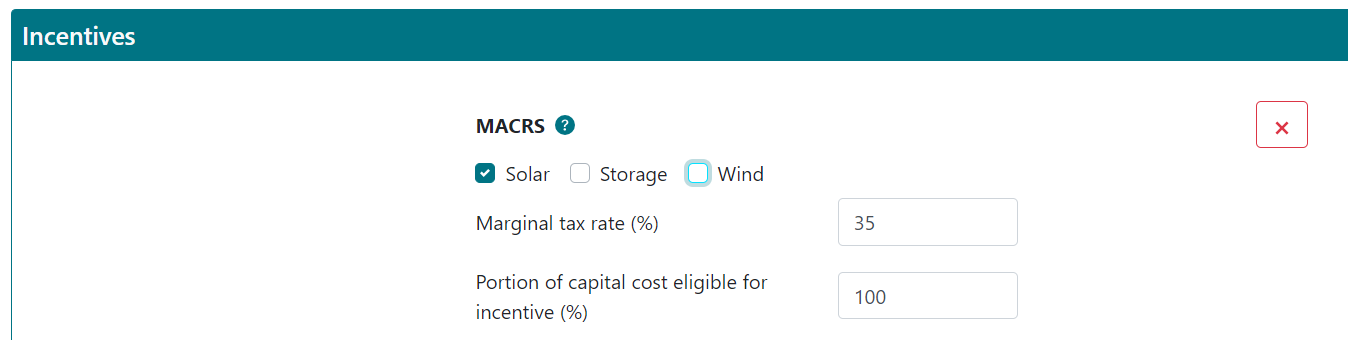

In HOMER Front, you can apply MACRS to the following components:

- Solar

- Storage

- Wind

Below is an explanation of the various inputs in MACRS

| Variable | Description |

|---|---|

| Marginal tax percent (%) | The percentage of tax rate on the purchased asset |

| Eligible percent (%) | Percentage of the capital cost eligible for the incentive |

| Applies to | The components that this bonus depreciation applies to |

Example

Assume a Storage of 100 kWh with a total capital cost of 100,000 $. Apply the below MACRS incentive to the PV component.

Assume that our simulation did not include a PV component. From the schematic from NREL, we know that this storage system is eligible for a 7 year MACRS. Then according to the 7 year MACRS schedule from IRS:

| Year | Percentage (%) | MACRS value ($) |

|---|---|---|

| 0 | 0.1429 | 0.1429 * 0.21 * 100,000 = 3001 |

| 1 | 0.2449 | 0.2449 * 0.21 * 100,000 = 5143 |

| 2 | 0.2449 | 0.2449 * 0.21 * 100,000 = 3673 |

| 3 | 0.1249 | 0.1249 * 0.21 * 100,000 = 2623 |

| 4 | 0.0893 | 0.0893 * 0.21 * 100,000 = 1875 |

| 5 | 0.0892 | 0.0892 * 0.21 * 100,000 = 1873 |

| 6 | 0.0893 | 0.0893 * 0.21 * 100,000 = 1875 |

| 7 | 0.0446 | 0.0446 * 0.21 * 100,000 = 937 |